Brief Overview of US Health Insurance

The healthcare system in the United States (US) may differ from other countries. For instance, in some countries, a patient visits one doctor for a variety of healthcare needs. In the US, a patient may see multiple doctors for various diagnoses and/or treatments. Additionally, the cost of healthcare in the US varies depending on a patient’s health insurance coverage, quite possibly ranging from several hundred dollars for a single doctor’s visit or several thousand dollars for an emergency room visit. Since getting sick or having a medical emergency isn’t planned, it’s important to have coverage for whenever care or treatment is needed.

As the consumer, you pay an upfront premium to a health insurance company that allows you to share the “risk” with other consumers who are making similar annual or monthly payments. Health insurance companies extensively collect and study massive amounts of data assessing the risk and cost of various lifestyle factors that might affect a consumer’s health. The advertised health insurance premium reflects the amount of money necessary to cover healthy individuals who might have a medical emergency in addition to individuals who seek medical treatment on a consistent basis.

Aetna’s Student Health Insurance Plan is rated as one of the top 5 health insurance policies for domestic and international students, providing a variety of medical and behavioral health services, treatments, and resources to its policyholders. To best utilize and understand Aetna’s health insurance plan, we recommend you review the guidelines and resources below.

Access your health insurance, your insurance card, find a healthcare provider.

Aetna is the health insurance carrier through NYFASHIP. NYFASHIP is administered through Academic HealthPlans (AHP). AHP manages the websites, enrollment, and waiver processes. Use the link below to access your health insurance plan.

It’s important to always carry a copy of your insurance card with you. To access your Aetna ID Card, use the link below and go to “Additional Resources” on the Home page.

Find a healthcare provider for your needs. Use the link below and go to “Find a Provider” on the Home page.

Questions? Go to the “Chat” function at the bottom of the Home Page, or go to “Contact Information” for additional assistance. If you need additional help, click help.ahpcare.com or email healthinsurance@nyfa.edu.

Claims and Medical Bills

When creating an account with Aetna, you can view previous and current medical claims along with the associated Explanation of Benefits documents (EOBs). You can also file claims by uploading medical bills and submitting them to Aetna. Aetna uses its secure messaging system to communicate with you regarding billing and/or any sensitive personal information.

Understanding Health Insurance Terminology

Insurance companies use various terms to describe costs and documents regarding a patient’s medical services. It’s important to understand these terms as you utilize Aetna’s insurance and navigate the billing/claims process. The defined terms below are general health insurance terms that will better help you navigate the health insurance processes. If you want a more all-inclusive health insurance glossary, you can find one here.

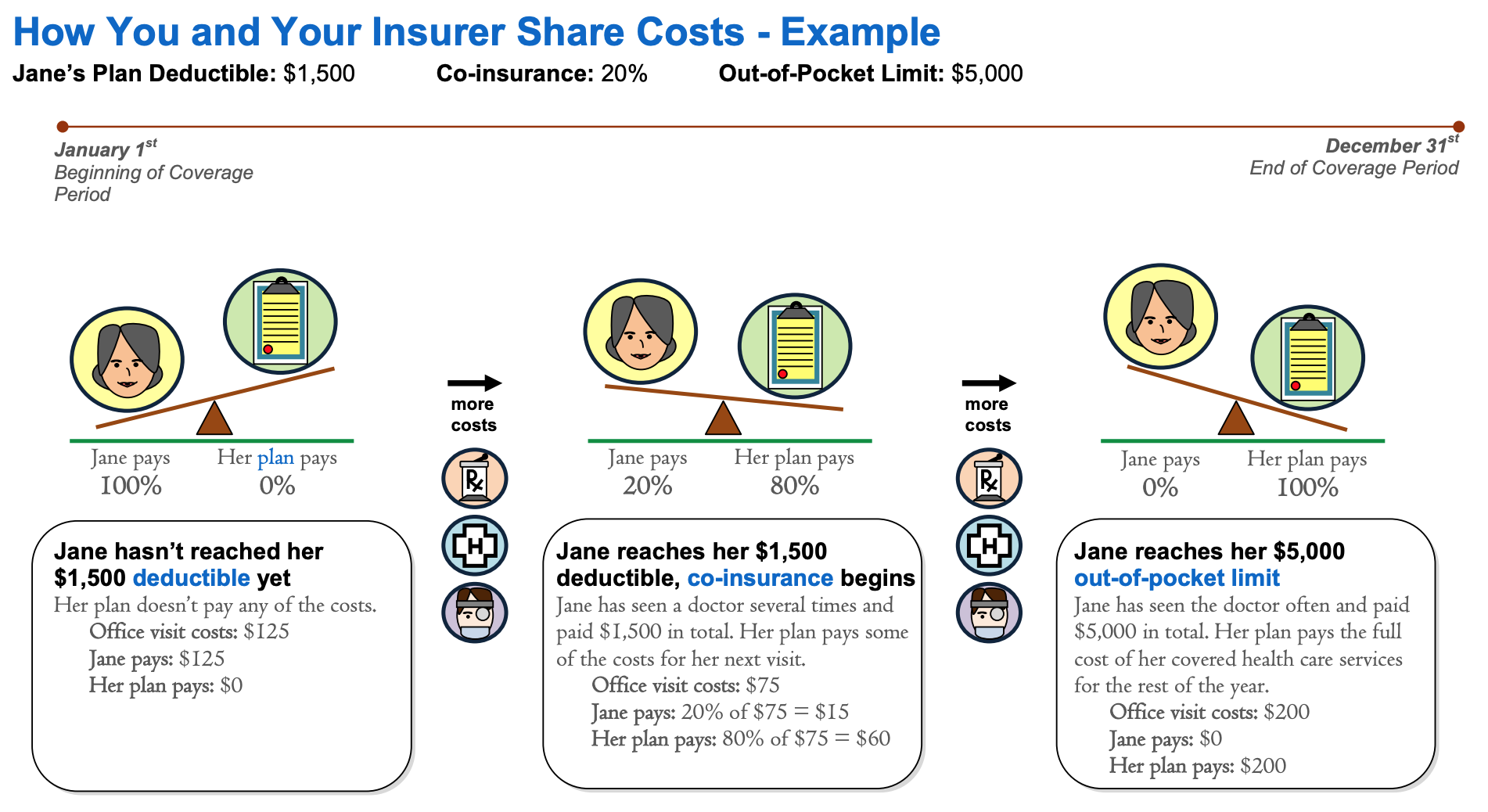

Coinsurance

This is a percentage of medical bills you’re responsible to pay after your deductible. This can apply to larger medical bills and/or specific medical procedures/services.

Copay

This is an amount of money you pay for healthcare expenses prior to the healthcare service or office visit. For example, with Aetna’s Student Health Insurance Plan, there’s a copay for specific doctor office visits ranging $5-$20 per visit. Copays vary by doctor office, specialty, and/or healthcare facility.

Deductible

The amount of money you pay for covered services before your health insurance carrier begins to pay. For Aetna’s Student Health Insurance Plan, the deductible is $250 per policy year.

Explanation of Benefits (EOBs)

This is a statement insurance companies send to the patient, explaining the charges for the corresponding medical service. With Aetna’s Student Health Insurance Plan, these can be found with the “Claims” tab within your account.

HMO

HMO, also known as a health maintenance organization, means that the specified health plan arranges health care services for its members. The primary care physician (PCP) from the plan’s health provider will refer patients to network specialists if special care is needed.

Out-of-Pocket Limit

An out-of-pocket limit is the limit on the costs a health plan member must pay for covered services.

PPO

Aetna’s Student Health Insurance Plan is an Open Choice PPO. PPO, also known as a preferred provider organization, means this is a type of health benefits plan where members can see any type of doctor without a referral from a general primary care physician.

Premium

A premium is the amount of money paid to the insurance company for the insurance coverage.

Specialist

A healthcare professional who specializes in a specific medical area, such as sports medicine, skincare, the heart, the brain, women’s reproductive health, and more.

Additional Available Resources

24/7 Nurse Hotline

If you need non-emergency healthcare guidance, you have access to a Nurse’s Hotline 24/7. The 24/7 Nurse Hotline provides helpful information on the following:

- Additional information on more than 5,000 health topics

- Making better healthcare decisions

- Finding out more information on a medical test or procedure

- Preparing for a doctor’s visit

When Aetna asked members who’d previously utilized the 24/7 Nurse Hotline, 93% said it improved their satisfaction with the insurance policy and 95% stated the hotline proved to be an important benefit to their health plan. To call the Nurse’s Hotline, please dial (800) 556 – 1555. TDD for hearing and speech impaired people only, please call (800) 270 – 2386.

24/7 Teladoc

If you need non-emergency medical care, TelaDoc provides members access to U.S. board-certified doctors via phone, who can provide support on a wide range of topics, including the flu, bronchitis, allergies, eczema, acne, skin rash, and more. At $40 or less per consultation, it costs less than the emergency room or an urgent care visit. To utilize this service, please dial (800) TELADOC or (800) 835 – 2362.

If you need non-emergency Integrated Behavioral Health Case Management you have access to U.S. board-certified doctors and licensed therapists via phone, who can provide support for a wide range of issues, including stress, anxiety, eating disorders, depression, grief, family difficulties, and more. At $40 or less per consultation, it costs less than the emergency room or an urgent care visit. To utilize this service, please call (877) 351-7889.

After setting up your Teladoc account and completing your medical history you can:

- Connect with a board-certified licensed doctor, dermatologist, or therapist

- Get care without leaving home or sitting in a waiting room

- Speak with a doctor in less than 10 minutes

- Video appointments can be scheduled to meet your schedule from 7am to 9pm, 7 days a week

Student Health Well-Being Resources

Aetna provides resources for students who take a holistic approach to healthcare, focusing on emotional, physical, and mental health. Aetna provides resources within the topics below to ensure students have all the resources they need to stay healthy and feel their best while attending school.

- Physical Health

- Emotional Health

- Depression & Anxiety

- Suicide Prevention

- Stress

- Eating Disorders

- Substance Abuse

- Relationship & Sexual Violence

- LGBTQ Resources

To access these resources:

- Go to your campus website.

- Select “View your Insurance Plan Details”

- Select “Student Health Well-Being”